HOW TO DEDUCT A SOLAR PUMP FROM YOUR TAXES

What Has Changed in 2025?

As we head into December, this is a critical time of the year for ranchers, farmers, and business owners. Not only do operators have to plan their moves for 2026, they also have to finalize end-of-year purchases to minimize their tax liability and make sure they have more cash to put towards their business rather than Uncle Sam.

A lot has changed in 2025 when it comes to how ranchers and farmers should approach their taxes. The amount you can deduct under Section 179 increased for 2025, but the end of 2025 also marks the end of clean energy tax credits under the Inflation Reduction Act (IRA “Option B”).

So what does this mean for you? In short, the increased deduction limits give you more opportunities to decrease your tax bill as a rancher or farmer, but with the sunset of certain credits under the Inflation Reduction Act, you’ll have to act fast to claim clean energy tax credits for 2025.

Keep in mind that this is just a quick primer on a few ways to limit your tax liability this year. While we do pride ourselves in keeping up with how changes to the tax code affect our customers, we are not tax pros! Be sure to reach out to a qualified tax advisor so that you know how best to approach your particular situation.

Section 179 Will Allow Ag Operators to Deduct Even More Going Forward

Section 179 offers big benefits to farmers and ranchers, as it allows them to deduct the cost of qualifying equipment (such as a solar pump used in a ranching operation) rather than depreciating it over time. 2025 brought some good news on this front, as the deduction limit was raised from the previous $1,220,000 to $1,250,000. Phase-out thresholds were also increased from $3,050,000 in 2024 to $3,130,000 in 2025.

These limits were increased even more for 2025 under the One Big Beautiful Bill Act (OBBBA). Amendments to Section 179 under this law increased the deduction limit to $2,500,000, and bumped up the phase-out threshold to $4,000,000 for property placed in service in taxable years after December 31, 2024.

How does this affect ranchers and farmers? For one, equipment placed in service in tax year 2025 or later is now subject to a Section 179 deduction cap of $2,500,000 (phasing out at $4,000,000), giving operators significantly higher dollar benefits going forward. If you’re a rancher, farmer or business owner looking to reduce your tax liability, Section 179 should be the first thing you look into, as it allows you to write off the entire solar pump kit. Keep in mind that you should still confirm with your tax professional to make sure that the “placed-in-service” dates and the “more-than-50%-business” rule apply to your property in order to get the maximum deduction for 2025 and 2026.

Time Is Running Out to Utilize Inflation Reduction Act Tax Credits

The Inflation Reduction Act (IRA) offered some sizable benefits to ranch operators and homeowners alike, with a generous 30% tax credit for the cost of qualified clean energy property.

What has changed with the IRA in 2025?

The biggest changes to the IRA came with the passage of the OBBBA in 2025, as this bill added new termination dates for a host of clean energy tax credits. Under OBBBA, many of these tax credits are sunsetting earlier than expected. Tax credits for residential installations in particular are expected to sunset after December 31, 2025.

So if you want to take full advantage of IRA tax credits, move fast to make sure your improvements are still eligible by installing before the end of 2025! If you’re planning to install a system in 2026, check with your tax professional to see if you still qualify for other residential credits, or if a business classification might apply instead.

Which RPS Systems Qualify For IRA Tax Credits?

Under IRS residential clean energy guidance, only “qualified clean energy property” applies for tax credits under the IRA. That means that equipment like solar panels, panel wiring, panel mounting, controllers and battery storage of at least 3 kWh should count towards this credit, but other hardware like submersible pumps, booster pumps, and drop pipe will likely be ineligible.

So for example, if you end up purchasing an RPS 400 and putting it in service before the end of 2025, you could expect to write off:

- Four Solar Panels

- The RPS Universal Controller

- Panel wiring

You could also add on some other eligible components to this RPS 400 system, such as:

- Batteries (total storage capacity of at least 3kWh)

- Mounting for solar panels

If parsing out which parts of a system are eligible seems confusing, don’t worry! Our solar pump specialists can help you by providing a custom write-up of eligible components.

Eligible battery storage still must must store at least 3 kWh! Straight from the Inflation Reduction Act language…

“(2) DEFINITION OF QUALIFIED BATTERY STORAGE TECHNOLOGY EXPENDITURE.—Paragraph (6) of section 25D(d) is amended to read as follows: ‘‘(6) QUALIFIED BATTERY STORAGE TECHNOLOGY EXPENDITURE.—The term ‘qualified battery storage technology expenditure’ means an expenditure for battery storage technology which— ‘‘(A) is installed in connection with a dwelling unit located in the United States and used as a residence by the taxpayer, and ‘‘(B) has a capacity of not less than 3 kilowatt hours.”

One last note on IRA Tax Credits

It is possible to claim Clean Energy Tax Credits in addition to deducting the cost of your solar pump system under Section 179, but there are a few caveats.

To claim both benefits, first apply the 30% clean-energy tax credit (ITC) to the eligible solar components, then reduce your depreciable (or Section 179) basis on the entire system by 50% of that credit amount before claiming the Section 179 deduction. In practice this means you get the tax credit on the solar gear and a reduced-basis depreciation (or expensing) for the pump system, avoiding disallowed “double-dipping.”

Eligible WaterSecure Kits

All of the Watersecure 3K, Watersecure 6K and Watersecure 12K kits are eligible for the 30% tax credit. All components are covered as well! The only rule you’ll have to abide by is the 3kWh battery bank storage capacity. RPS carries two kinds of batteries, 55 Ah and 160 Ah. To meet the 3 kWh requirement, you’ll need at least the Watersecure 3K-1200 system, which comes with eight 55 Ah batteries. Any of the Watersecure systems using 160 Ah batteries will also automatically meet the 3kWh minimum. All eligible Watersecure systems are listed below…

- Watersecure 3k-1200

- Watersecure 3k-1800

- Watersecure 6k-800

- Watersecure 6k-1200

- Watersecure 6k-1800

- Watersecure 6k-2400

- Watersecure 12k-1600

- Watersecure 12k-2400

Keep in mind that timing matters for these tax credits! Clean energy credits may not be applicable for residential property placed in service after 2025, so ensure that your placed-in-service date and component cost allocation are documented. For installs completed in 2026 or later, check with your tax professional to see if other non-residential credits are available.

How do I Expense as RPS Solar Pump or WaterSecure Kit?

- Confirm you qualify for the 30% tax credit

- Collect documentation from your purchase and install project (RPS can provide receipts and any other paperwork you require).

- Invoices, receipts, component cost breakdowns, installation/placed-in-service date are all needed to get the biggest deductions and tax credits possible.

- Complete IRS Form 5965 (for residential installs), or IRS Form 4362 (for business installs)

- Add the credit to Form 1040

Important! RPS is a solar water pump company dedicated to saving you fistfuls of cash, but we are not tax specialists! Every rancher, farmer, off-gridder and homeowner will have different tax circumstances. Please consult with your dedicated tax professional to confirm eligibility write offs. This is especially important if you’re planning an install for 2026 or later, lean on your tax advisor to confirm whether these credits and deductions are still applicable for your placed-in-service year.

To take advantage of 2024 tax deductions you’ll need to purchase a solar pump by December 31, 2025. Our end of year can get pretty busy, if haven’t already, we suggest calling in and speaking to one of our solar pump specialists to get the planning process started. No one is on commission, we just want to get you the right solar pump for your property and save you some money! Call an RPS team member at 888-637-4493

Take your water needs into your own hands with our help!

Find The Right System For You!

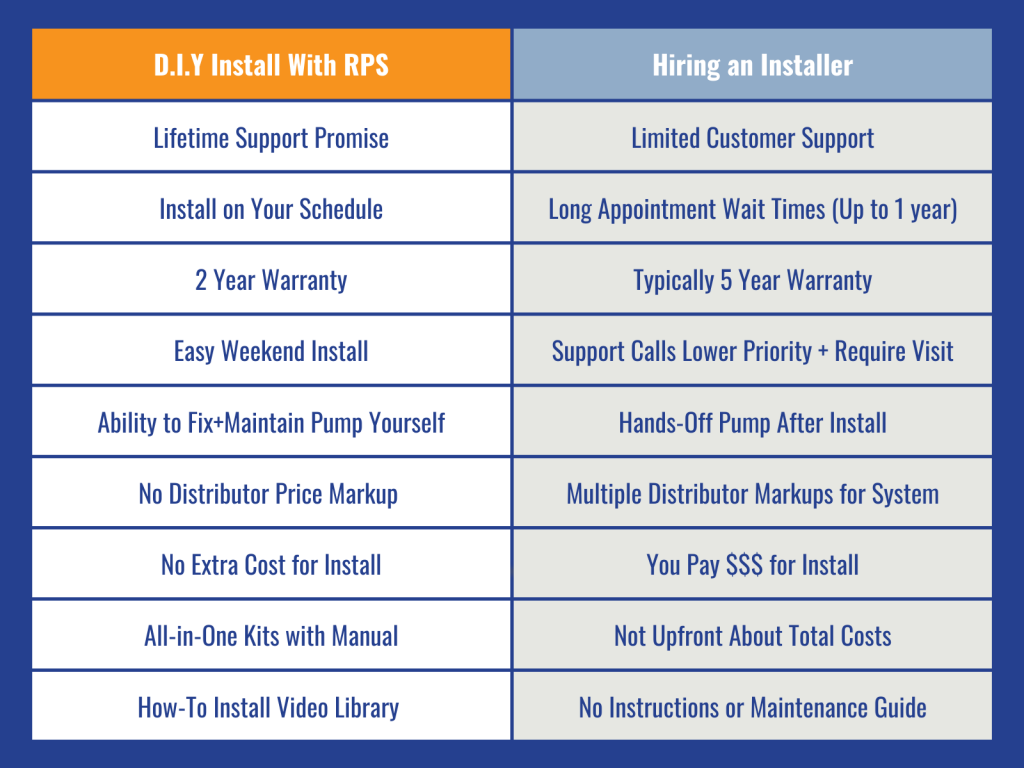

WHAT ARE THE BENEFITS OF A D.I.Y. INSTALL WITH RPS?

These Folks Did It Themselves and You Can Too!

“The support from RPS is the very best in the business. We are so glad we chose RPS for our off grid farm. Thanks!”

– Dave, CA

“I don’t know how to thank you, I am a home builder in Jasper, Texas. I believe in proposes made, promises kept. My order was delivered on Thursday and was short the half turnkey, but you guys went the extra mile to get it to me overnight. I made my 10 hour trip , and installed this morning, back in time not to affect my schedule. You guys are just the greatest, and installed in 4 hours …. If all companies were like this! I give you 10 stars and thank you again for the great service, I will use on every well in the future, thanks again”

– Jim, Owner of Shabar Homes, TX

“We have two wells using 100% solar power to bring water up from 110 feet deep wells to irrigate 4 cultivated acres of fruit and nut orchard crops and it is the BEST THING EVER!!! Free flowing water during the day into our tanks that then send water to our crops in a drip irrigation system (also using this company’s Tankless Pressure Pump). I waited several months to leave this review and now I am a raging fan. Thanks to RPS we can operate completely off-grid to grow food in a regenerative sustainable way. Farm is in Oregon on Instagram at The Farm Up Lost Creek.”